What Happened?

Published 23-MAR-2024 10:08 A.M.

|

10 minute read

It’s been a while since we added a new company to our Portfolio

Since September last year - almost 6 months ago.

We have a new one coming next week - as always we’ll send a “heads up” email the night before we announce it.

We also have more Portfolio additions coming up in the next couple of months.

But first, is the commodities supercycle back on?

Was it ever off?

The uranium price is going up again after a short breather.

Iron ore seems to be coming back this week after a strong run then quick pull back (by iron ore standards).

Gold and silver just keep on ripping upwards.

Lithium... has a heartbeat

The US is expected to cut interest rates in 2024.

It pushed the big end of the stock market up even further.

And hopefully stimulates global economies which flow through to consumption which flows through to commodities.

Eventually the sentiment surely has to start flowing to the small cap space.

ASX small caps showed another week of, let’s call it, NOT being terrible.

(we’ll take that over the usual horrors we have grown used to over the last year)

In our opinion small cap share prices are still looking attractive.

We have mostly been participating in placements in our existing Portfolio companies - a good chance to average down initial entry prices for the next bull run.

A game of patience and conviction which sometimes isn’t fun, but hopefully will ultimately be a smart move when sentiment turns.

And it has started to turn a bit, a few of our companies have now moved off their lows, and a few placements we went into over the last 12 months are looking positive.

Another bright spot we noticed in the last couple of weeks (bright in some ways but also annoying in others) was there are scalebacks happening on capital raises.

In bear markets cap raisings are hard work and companies/brokers struggle to find enough cash to reach the target cap raise amount.

Scalebacks usually only occur in strong markets.

Scalebacks are a good sign because it means there is more money trying to pile into a cap raise then there is available room to fit it all in.

People will bid a certain amount that they want to invest in a placement, but then bid amounts are reduced (scaled back) in order to fit everyone into the placement maximum amount.

Scaled back bidders will have to go and buy on the market IF they want their full amount of new shares.

We saw significant scalebacks on placements in WHK and DXB.

And on Friday we saw a big scale back on the ALA placement.

How we see the markets playing out over the next few months:

The period leading up to the Easter weekend and the weeks following it are usually a busy period for the market.

During this period companies look to get as much newsflow out to the market as possible.

The Easter weekend means two weeks of disrupted trading in markets & usually a period where some people take a short break.

So companies have a brief window to get news out to the market, see their share prices re-rate upwards (or in negative scenarios, downwards).

For the companies that need to raise capital it also means there is a small window on either side of Easter to get a capital raise done before the end of the financial year.

Because of these market nuances, April is usually a pretty good month for share price performance.

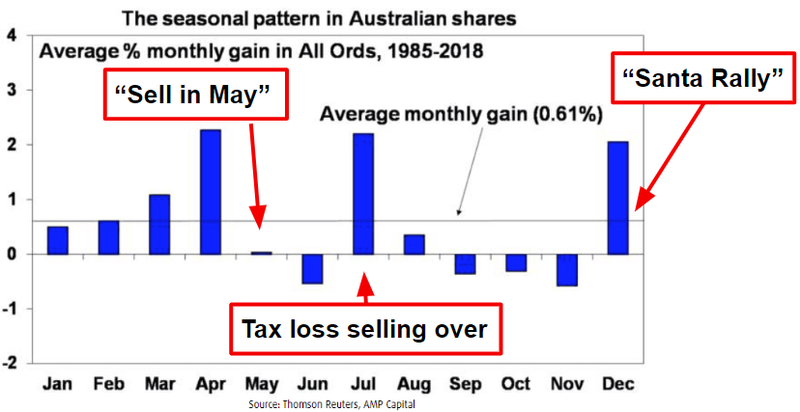

Below is a chart that tracks the seasonality of the All Ordinaries (largest 500 companies in Australia) and how April is typically one of the strongest performing months of any year between 1985-2018:

( Source )

This is a general pattern, but we suspect the next few months are going to be a bit different in the small cap space...

According to the general rule of thumb and the above chart, April could be considered a good time to be holding stocks and trimming winners so cash can be deployed into stocks that suffer through the May (sell in may and go away) and June (tax loss selling) months.

We think there is a good chance May and June play out the opposite way this year.

There has now been TWO bear market “sell in Mays” and “June tax loss selling” periods - in 2022 and 2023.

The post bull market vomits have likely already happened, and most beaten up small cap investors who needed to tap out have probably already done so.

It’s evident over the last ~6 weeks where we have seen some of our companies release good news, the share price goes up... and STAYS up.

When good news isn’t met by selling, it means that most investors on the cap table are happy to hold and have the financial means to wait for material gains over time.

The next waves of sells will come when the share price goes up enough to entice a few bear market entrants to take some profit off the table.

Of course, at the end of the day, markets rarely ever do what everyone expects - so it will be interesting to see how the next 2-3 months play out this May and June.

Having said that, our Investments are less about timing and more about finding what we think is value.

So far this year we have been relatively quiet when it comes to new Investments - as we noted above, our last was announced back in September 2023.

This week we will be announcing our first Investment for 2024 so be on the lookout for an email at some point this week.

We are also looking to add a few more names to our portfolio over the next 4-8 weeks so be on the lookout for those as well.

Where are we seeing good opportunities in the small cap space?

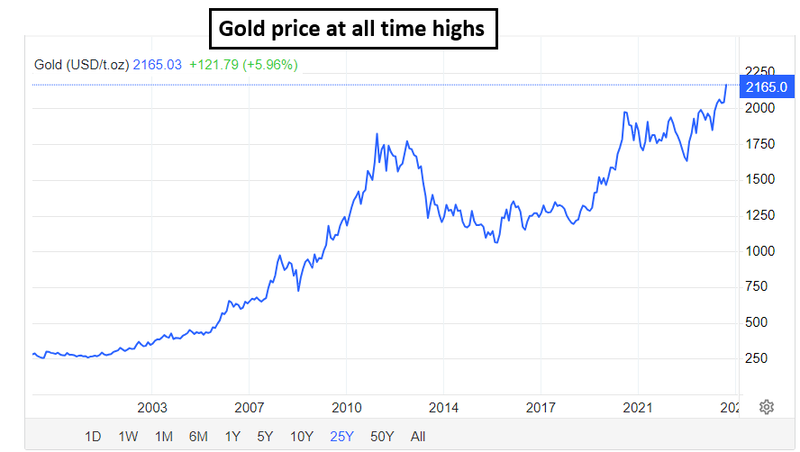

One sector that is trading against fundamentals is gold.

The gold price is trading at all time highs but small cap gold explorers can’t catch a bid.

The larger companies are trading at relatively strong valuations and there is a wave of M&A.

Yet none of that capital is flowing down into smaller companies.

We think the gold companies will eventually get their day in the sun and the current sentiment will have to change as the gold price keeps going up and up...

Another one is silver.

Silver prices often follow gold prices - albeit with some lag.

Silver, like gold, is considered a precious metal BUT also has industrial uses.

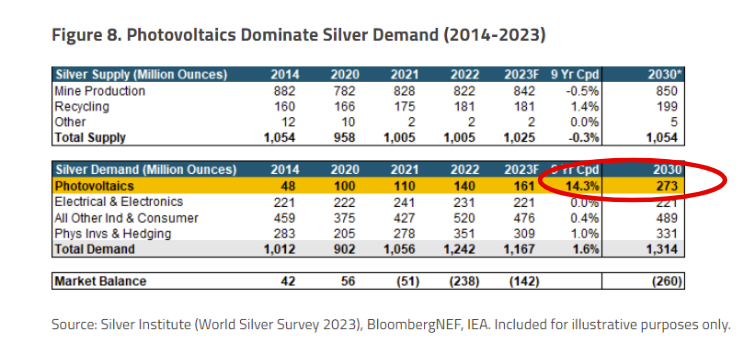

Silver is used in the manufacture of photovoltaic (PV) cells found in solar panels.

While the increase in demand for silver from PV cells has been long anticipated - what we’re seeing in the market is that this demand is now starting to ramp up.

For instance this table from Sprott published late last year shows the demand from PVs growing from 2014-2023:

(Source)

PVs are easily the fastest growing input into total silver demand - and will almost match the demand from physical investment and hedging by 2030.

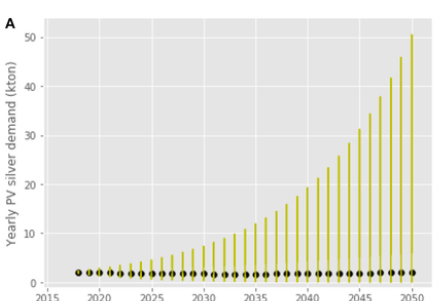

What we do know about tech is that generally things surprise to the upside - and the portion of silver demand from solar looks exponential to us:

(Source)

This means there is industrial buying AND buying for storage of wealth.

On top of that, silver focused companies are hard to find on the ASX because capital has stayed away from the sector for so long.

We have been looking at a few silver names in the past few weeks and will be looking to make a few Investments over the coming weeks.

Interestingly Rick Rule is also bullish and says he is “buying silver stocks right now”.

For those who haven’t heard of Rick before, he is one of the most successful resources investors in the world and he was the founder of Sprott Asset Management..

He was lucky enough to be an early investor in Predictive Discovery which made a gold discovery in West Africa back in April 2020.

Predictive’s share price went from ~0.7c to a high >28c per share.

See his take on silver here:

(Source)

For the Rick Rule fans out there, the following interview is also a really good one.

In it he talks about how for years it was hard to find value in micro caps but now, with capital hard to come by, he is seeing value and is back investing in small companies again.

We tend to agree, especially with the offers on some of the capital raises floating around the market these days.

(Source)

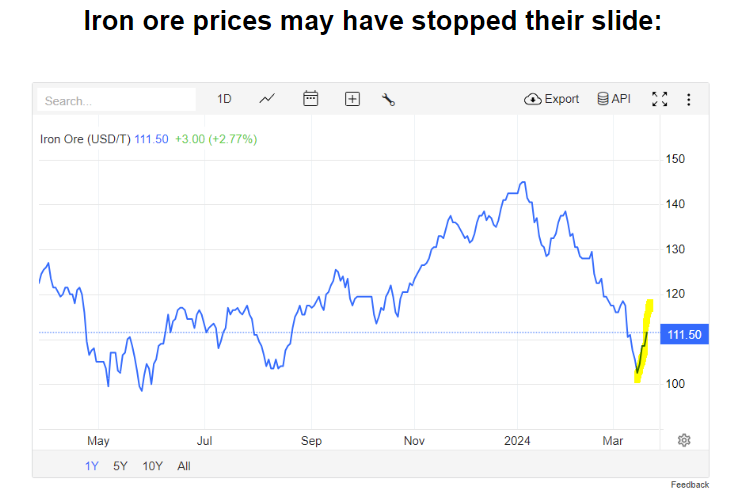

Another sector we are looking at is iron ore

Iron ore is what makes steel possible - and steel is the backbone of economies around the world.

So we’re looking at the iron ore sector closely to see what kind of value there may be out there.

Iron ore had a big run in late 2023 then came off a bit over the last few months...

Over the last week it has bounced back significantly.

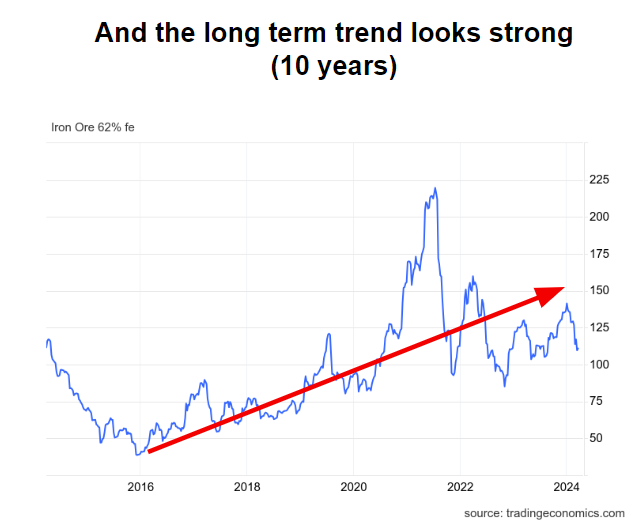

Regardless of the short term ups and downs, the general trend of the iron ore price over 10 years looks better:

Our reasoning on iron ore comes back to some of the same reasons we think gold and silver are in good or better shape - monetary policy and industrial activity.

The RBA and the US Fed are hinting that rates may come down - maybe not as quickly as some hope.

With that said the two central banks would likely ease rates if the economy slowed too sharply - but the longer rates remain high - the more incentive there is for governments around the world to chip in their own money to keep the show going.

That fiscal stimulus is what usually leads to infrastructure spending and that infrastructure spending needs lots of steel.

So we’re on the lookout for more exposure to iron ore, specifically later stage iron ore projects that will likely become a producing mine within the next few years.

As always we are keen on blue sky exploration too.

What we wrote about this week

Global Oil & Gas (ASX: GLV)

GLV reconfirmed a historical discovery at its giant offshore oil and gas block in Peru. The latest target area now has a contingent resource of 404 Bcf and a prospective resource of 2.2 Tcf.

We recently Increased our Investment in GLV at the 1.5c per share placement. GLV is already up 33% from our Initial Entry Price and 66% on the placement.

Read: GLV announces details of historical At gas discovery

Neurotech International (ASX:NTI)

NTI is one of our biotech Investments. NTI is looking to develop treatments for rare and severe neurological disorders predominantly in children.

In a few weeks time we expect to see results from TWO NTI clinical trials - one targeting Rett Syndrome and the other Autism Spectrum Disorder (ASD) - both results are expected in ‘Q1 or early Q2’ (which is around about now...).

Read: TWO major share price catalysts...

Kuniko Ltd (ASX:KNI)

KNI kicked off a geophysical survey across its nickel-copper-cobalt projects in Norway.

KNI as an Investment is exploring for critical minerals inside the EU and is already backed by one of the biggest carmakers in the EU - Stellantis - which owns ~19.4% of KNI.

The European Union (EU) has made securing local, clean battery metal supply a key strategic priority. Which is great - but the local resources need to be successfully discovered and developed - which is what KNI is aiming to do.

Read: KNI share price moving up over the last two weeks...

Quick Takes

GAL: GAL Sets Targets Ahead of April Drill Program

IVZ: IVZ Lab Results from Mukuyu Discovery

BPM: BPM AC Drill Results from Claw Gold Project

TYX: TYX Lithium Exploration Update

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc:

The Future Money: https://future-money.co/

South Africa’s Climate Transition Dilemma

Macro News - What we are reading

Oil and Gas:

Innovative solutions will be necessary to reduce methane emissions (ABC News)

'We should abandon the fantasy of phasing out oil and gas': Saudi oil CEO (yahoo.com)

Copper:

China Copper Smelters to Discuss Fees as Crisis Roils Sector (Bloomberg)

Energy:

Urgent action needed if Australia is to avoid catastrophic gas shortfall (The Australian)

Gold:

What Little ‘Gold Beans’ Are Teaching Young Chinese About Alternative Savings (Bloomberg)

Gold surges as expectations for future interest rate cuts retained (miningnews.net)

Graphite:

US IRA scheme spurs activity on multiple fronts in graphite anode sector (Fastmarkets)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.